PART ONE: THE HOMES

Homes are devalued, banks have restricted lending, and it's "virtually impossible" to sell.

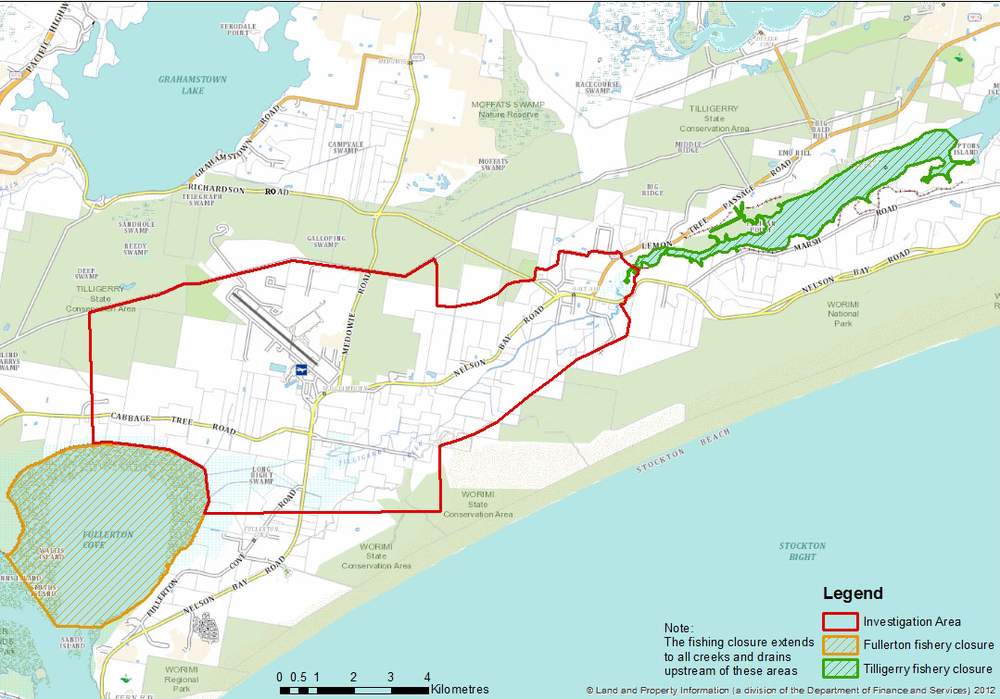

The Williamtown RAAF Base contamination scandal has devastated the area's property market, and the lives of the people who live there.

Michael McGowan and Carrie Fellner report.

THEY feel trapped.

Late last year, seeking a change of scenery, husband and wife Craig Afflick and Leonie Gibson decided to sell their Williamtown home.

They signed up to a real estate company, paid for conveyancing, and set to work painting the house in preparation for a sale.

“Then we found out about the red zone, and it all came to a screaming halt,” Ms Gibson said.

In the middle of December they received an email from a local branch of the National Australia Bank that put their lives on hold indefinitely.

“It is with deep regret that I have to advise valuations are not currently being conducted in this area and I am not in a position to extend any new lending against the Williamtown property at this time,” it read.

The stunning note, which Ms Gibson says left her feeling “shocked and disappointed” confirms what until now has only been suspected: the value of property in Williamtown and the surrounding suburbs have been devastated by the contamination scandal.

A Newcastle Herald investigation can reveal for the first time the extent of the impact on properties in the contamination red zone surrounding the Williamtown RAAF Base.

Valuers are refusing to inspect properties because of occupational health and safety issues, loan offers have been withdrawn at the 11th hour, and banks are imposing restricted lending on properties within the contamination plume.

After they were dropped in the red zone, the couple began the process of having a valuer reinspect their home.

“We own the house and it cost between $550 and 600 thousand originally, we wanted above that,” Ms Gibson said.

But the valuer wouldn’t even attend their property, citing “occupational health and safety” as the reason in correspondence sent to the bank and seen by the Herald.

The email states that “properties in the location of the subject property have been identified as being potentially in an area affected by a contamination incident caused [by] fire-fighting foams from the nearby Williamtown Royal Australian Air Force Base” and that “the full impact of potential contamination is unknown”.

“Until environmental studies are completed it is considered that property within the contamination zone will suffer buyer resistance and could be further impacted as lending institutions introduce new lending restrictions in the short term,” the email reads.

A spokeswoman for the NAB said the bank was “closely monitoring updates from relevant government agencies and will continue to update our approach as new information becomes available”.

However the Herald has been able to confirm that the bank is not offering new lending in the red zone, and other banks including ANZ and the Commonwealth have made similar decisions.

“We feel like we can’t move forward with our lives,” Ms Gibson said.

It’s just one example in what has developed into a property purgatory for home owners as a result of contamination from the RAAF Base.

“I didn’t work all my life for this,” he said. “It’s a bit demoralising.”

Unwilling to sell his home at such a low price and desperate to buy a home currently on the market in Raymond Terrace, Mr Edwards sought financing from the ANZ Bank for a bridging loan, using his existing property as equity.

At first he was elated when he received conditional approval, then he read the fine print. Included in the valuer’s report was the familiar caveat that the property is located within red zone.

“We require confirmation of the ANZ's lending policies for properties subject to potential PFOS and PFOA contamination prior to proceeding with this valuation request,” it read.

A fortnight later he was knocked back. His broker included a sad face at the end of the email confirming the news.

“I could look into other lenders but feel that we may come up with a similar issue if a valuation is required,” she wrote.

The banks say their hands are tied until more information is forthcoming from either the Department of Defence or the NSW Environmental Protection Authority, and neither Mr Edwards, Ms Gibson or any of the property owners the Herald has spoken to placed blame on the banks or the valuers.

“If it was a private company that did what Defence had done, they would be sent to prison,” Mr Edwards said.

Terry Millett, the chief executive of the Newcastle Permanent, said the bank was adopting a “very cautious” and “case by case” approach to lending “for or against affected properties” in the area.

“So far, there is still very little information formally available to determine if property values in the area have been or will be affected by the contamination issue,” he said.

“However, we do recognise that the market value of the land could be affected even in the absence of any meaningful information.”

The problem has not gone unnoticed by the NSW Government, and the Department of Premier and Cabinet has been meeting with financial institutions since the beginning of this year.

In a statement, the Department of Defence said it had been “in discussion with the NSW Department of Premier and Cabinet about this matter, and is also in contact with banks”.

“Compensation for any losses or injuries will depend upon a determination as to liability and quantification of losses or injuries attributable to actions by the Commonwealth,” a spokeswoman said.

Part Two of this series will be published on Tuesday May 17.